The Maryland Chamber of Commerce has raised concerns over Governor Wes Moore’s latest budget proposal, arguing that certain provisions could have negative consequences for businesses across the state. While the governor’s administration has emphasized investments in education, infrastructure, and social programs, business leaders fear that increased taxes and regulatory changes may place additional financial burdens on companies, particularly small and mid-sized enterprises.

Chamber representatives have urged state officials to reconsider aspects of the budget that could hinder economic growth, warning that higher costs for businesses might lead to job losses or reduced expansion opportunities. They argue that while investments in public programs are essential, the approach should be balanced to ensure Maryland remains an attractive place for businesses to thrive.

A major point of contention is the proposed increase in corporate taxes, which chamber officials claim could discourage companies from setting up operations in the state or push existing businesses to relocate. Additionally, concerns have been raised about new labor regulations, which some fear could make it harder for employers to manage costs while maintaining a competitive workforce.

Governor Moore’s office, however, maintains that the budget is designed to create long-term economic stability by strengthening Maryland’s workforce, upgrading infrastructure, and addressing social disparities. Supporters argue that these investments will ultimately benefit businesses by fostering a stronger labor pool and improving public resources that drive commerce and innovation.

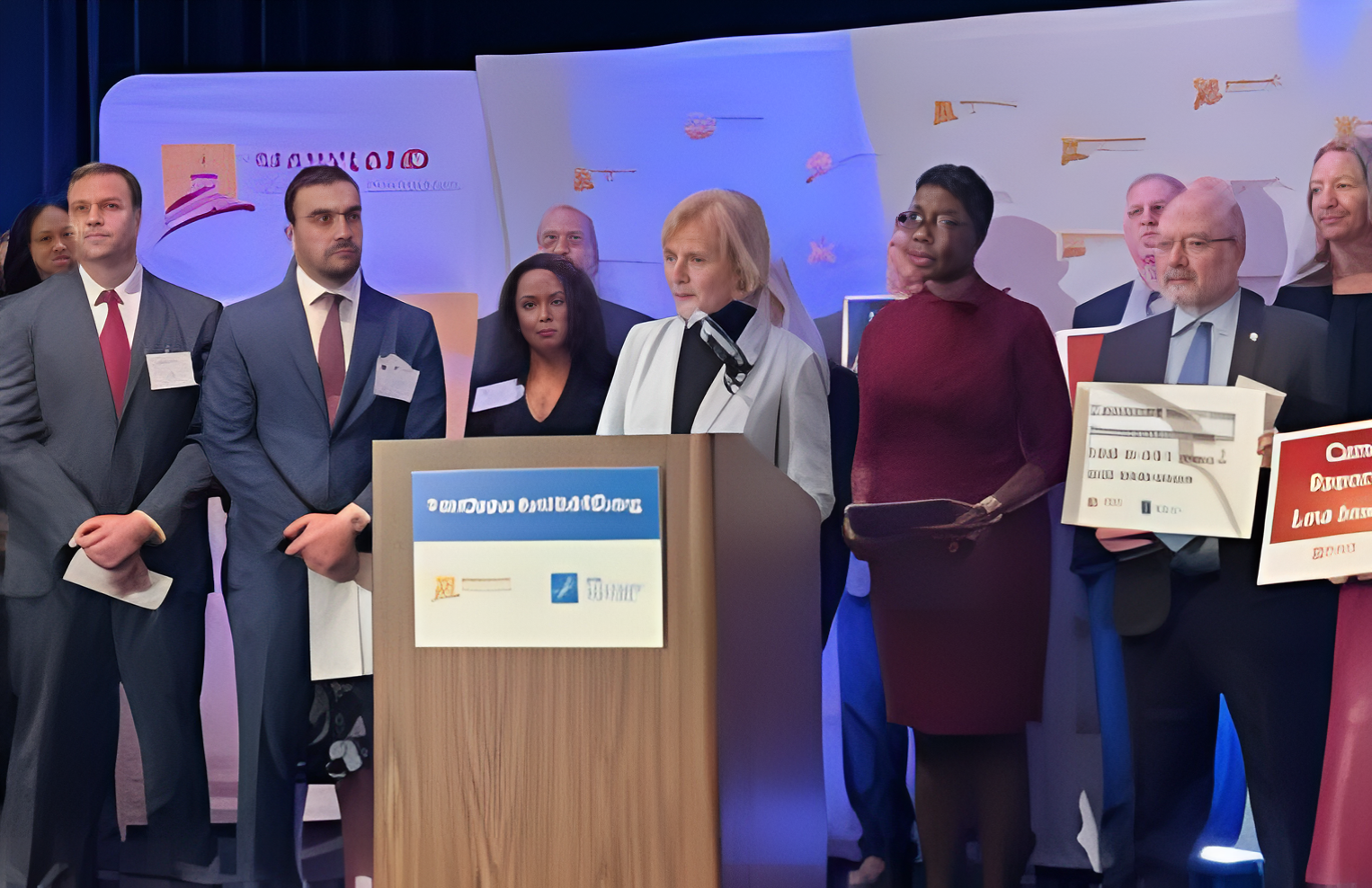

As the debate continues, business advocacy groups are expected to engage with lawmakers to propose alternatives that support economic growth without placing excessive strain on businesses. Public hearings and discussions will take place in the coming weeks, with stakeholders from both sides pushing for adjustments before the final budget is approved.